(LEAD) U.S. Fed holds key lending rate steady, pencils in 2 cuts this year

By Song Sang-ho

WASHINGTON, March 19 (Yonhap) -- The U.S. Federal Reserve on Wednesday kept its benchmark interest rate unchanged and signaled the possibility of two rate cuts this year, as it is cautiously assessing the ramifications of U.S. President Donald Trump's tariff policies and other measures that have stoked economic uncertainties.

After the two-day Federal Open Market Committee (FOMC) meeting, the central bank announced the decision to hold the rate steady at the 4.25 to 4.50 percent range. The pause on cuts came after a quarter-percentage-point reduction each in December and November, and a 50-basis-point cut in September.

FOMC members' new median economic projection showed the federal funds rate would be cut to 3.9 percent at the end of the year, to 3.4 percent next year and to 3.1 percent in 2027. In their previous December projection, they also forecast the rate would be lowered to 3.9 percent this year, penciling in two cuts for 2025.

In addition, the latest median projections indicated that Personal Consumption Expenditures inflation may reach 2.7 percent at the end of the year, higher than the December forecast of 2.5 percent.

This week's rate decision put the gap between the key rates of South Korea and the United States at up to 1.75 percentage points.

This file photo, released by the Associated Press, shows Federal Reserve Chair Jerome Powell speaking during the annual U.S. Monetary Policy Forum in New York on March 7, 2025.

sshluck@yna.co.kr

(END)

-

BTS Jungkook's Hybe shares hacked after military enlistment

BTS Jungkook's Hybe shares hacked after military enlistment -

Park Bo-gum reflects on beloved 'Gwan-sik' in Netflix series, his blossoming career

Park Bo-gum reflects on beloved 'Gwan-sik' in Netflix series, his blossoming career -

(Movie Review) Actor-director Ha Jung-woo's 'Lobby' offers satirical insight into 'golf business'

(Movie Review) Actor-director Ha Jung-woo's 'Lobby' offers satirical insight into 'golf business' -

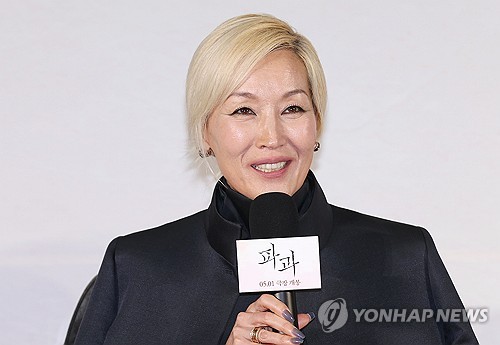

'The Old Woman With the Knife' breaks ground with female assassin in her 60s

'The Old Woman With the Knife' breaks ground with female assassin in her 60s -

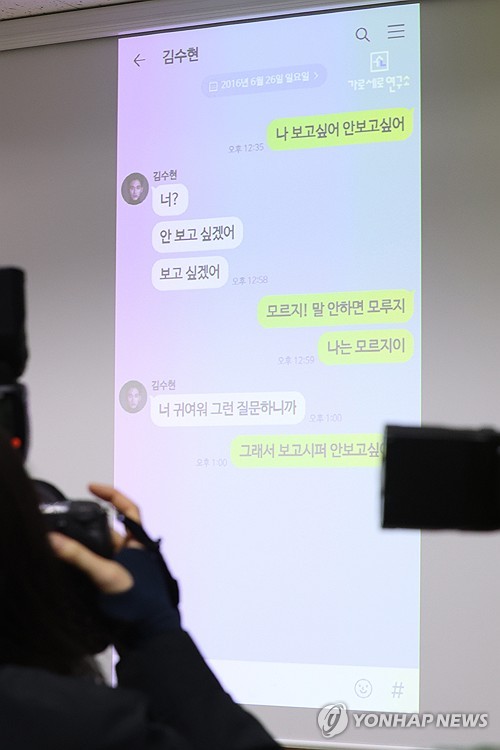

Kim Soo-hyun files lawsuit against YouTuber for blackmail

Kim Soo-hyun files lawsuit against YouTuber for blackmail

-

BTS Jungkook's Hybe shares hacked after military enlistment

BTS Jungkook's Hybe shares hacked after military enlistment -

Park Bo-gum reflects on beloved 'Gwan-sik' in Netflix series, his blossoming career

Park Bo-gum reflects on beloved 'Gwan-sik' in Netflix series, his blossoming career -

(Movie Review) Actor-director Ha Jung-woo's 'Lobby' offers satirical insight into 'golf business'

(Movie Review) Actor-director Ha Jung-woo's 'Lobby' offers satirical insight into 'golf business' -

'The Old Woman With the Knife' breaks ground with female assassin in her 60s

'The Old Woman With the Knife' breaks ground with female assassin in her 60s -

Kim Sae-ron's family releases alleged evidence of underage relationship with Kim Soo-hyun

Kim Sae-ron's family releases alleged evidence of underage relationship with Kim Soo-hyun

-

Kim Sae-ron's family releases alleged evidence of underage relationship with Kim Soo-hyun

Kim Sae-ron's family releases alleged evidence of underage relationship with Kim Soo-hyun -

(LEAD) N. Korea presumed to send at least 3,000 more troops to Russia: JCS

(LEAD) N. Korea presumed to send at least 3,000 more troops to Russia: JCS -

(3rd LD) Death toll hits 27 as firefighters battle to contain worst-ever wildfires

(3rd LD) Death toll hits 27 as firefighters battle to contain worst-ever wildfires -

(3rd LD) N. Korea releases photos of what appears to be airborne control aircraft for 1st time

(3rd LD) N. Korea releases photos of what appears to be airborne control aircraft for 1st time -

S. Korea-U.S. alliance is in 'quiet crisis': U.S. expert

S. Korea-U.S. alliance is in 'quiet crisis': U.S. expert